Is a private-equity research firm. The charts provided here are not meant for investment purpose(s) and only serve as technical examples. Trader Disclosure: See below for our Legal / Disclaimer.

Saturday, December 31, 2011

US Market TimeLine for Options

This is should give you some insight to the workings of the markets as a whole. The adrenaline rush generally last until 10:00 or 10:30 A.M. As, the most intense action in the market happens right when it opens. Nonetheless, options traders will be better prepared, That's it. No fancy stuff.

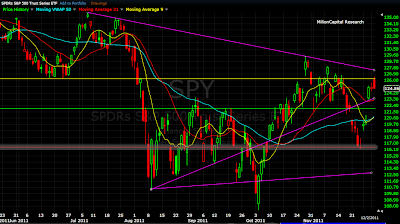

Chart was revised with Red line Boxes to an Option Traders standard. Basic chart was created by by Jerome "Mel" Hickerson is a technical analyst who uses software-generated analysis of breadth and institutional buying to trigger his signals for day trading indices and ETFs.

Thursday, December 29, 2011

GLD - 149.00 DEC C

7:01 AM Gold continues its late-year slide, off 2.4% to $1,526/oz., the lowest price since early July. Off 3.6% to $26.28, silver has returned to its low for the year.

AMZN - 170.00 DEC Call

7:22 AM Goldman's Heather Bellini suggests Amazon (AMZN) could miss consensus revenue forecasts of $18.19B (up 40%). The firm however, maintains its Neutral rating and $190 price target.

9:18 AM Amazon (AMZN) proclaims 2011 "the best holiday ever for the Kindle family," with sales of more than 1M of the devices/week throughout December, led by the new "Fire." The company also notes the success of its Direct Publishing program, with the #1 and #4 best-sellers on Kindle both published independently by their authors. Shares -2.7% premarket as Heather Bellini warns on the company's Q4 revenue.

General Market Observation

I have become convinced that when the profits run, let them run. However, when the markets aren’t moving much, it’s better to make a small profit and close position. Better to have cash on hand ready for opening a new position than to sit and wait out the market and wait for it to make more profit.

Wednesday, December 28, 2011

EURUSD

PT are the Red and Purple lines..

$EURUSD where will it go from here if the 1.29124 level is pushed through.

Dec. 28 at 5:13 PM

$EURUSD chart on a 5 min ... 1.29251 next price.. http://chart.ly/4bjck5y

Dec. 28 at 5:19 PM

$EURUSD almost at the 1.29251 area.... ES_F needs to pushed higher and help out. http://chart.ly/8sbdjdd

$EURUSD this is done

$EURUSD 5 min chart.... 1.29300 in the cards ... http://chart.ly/l7sg46u

$EURUSD Surpassed the 1.29300 area, on the 5 min chart. http://chart.ly/7b9iil6

GS = EURO

Today - Wednesday, December 28, 11:43 AM Europe closes at session lows, knocked for a loop by a rapid dive in the euro (to be fair, cable dropping right alongside), which began around 9 AM ET. Stoxx 50 -1.6%, Germany -1.9%, France -1.1%, Italy -0.7%, Spain -2%, U.K. flat. The euro continues to slide, -1.2% at $1.2920. Cable -1.2% at $1.5476.

The euro tumbled to 15-month lows after the ECB reported European banks had deposited a record amount. Financials were among the weakest stock sectors; commodities were clobbered. NYSE declining issues outnumbered advance's four to one.

Tuesday, December 27, 2011

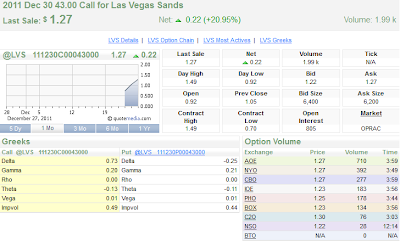

LVS - Lotto Option Play

This a mover on some Govt news, that the Obama Administration; new interpretation, by the department's Office of Legal Counsel, said the Wire Act applies only to bets on a "sporting event or contest," not to a state's use of the Internet to sell lottery tickets to adults within its borders or abroad.

"The United States Department of Justice has given the online gaming community a big, big present," said I. Nelson Rose, a gaming law expert at Whittier Law School who consults for governments and the industry."

Sunday, December 25, 2011

Saturday, December 24, 2011

Extending the Extended

3:07 PM The SEC announces that it's extending the public comment period on the Volcker Rule by 30 days after it was initially slated to end Jan. 13, 2012.

10:09 AM The House has approved the 2-month payroll tax cut extension. The bill now goes to the President for signing. As part of the bill, President Obama is forced to make a decision within 60 days on whether or not to approve construction of TransCanada's (TRP +1.1%) 1.7K mile pipeline.

10:09 AM The House has approved the 2-month payroll tax cut extension. The bill now goes to the President for signing. As part of the bill, President Obama is forced to make a decision within 60 days on whether or not to approve construction of TransCanada's (TRP +1.1%) 1.7K mile pipeline.

Saturday, December 17, 2011

SINA - Rebound - Options Weekly

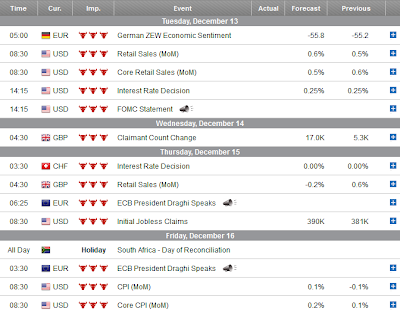

Tuesday, December 13, 2011

GS - OTM DEC 90 P

7:29 AM The euro gives up its moderate gains after a meeting breaks up between Greek officials and private bondholders without a deal being made on a debt swap, according to a banker involved. Negotiations will continue. Euro flat at $1.3197

7:55 AM The EFSF sells €1.97B in 3 month paper priced to yield 0.22%, with a bid/cover ratio of 3.2, according to the Bundesbank. The supposedly good news is being offered as a reason for the bounce in European shares and peripheral debt this morning. It was little more than a month ago that the EFSF hoped to have €1T in firepower.

7:55 AM The EFSF sells €1.97B in 3 month paper priced to yield 0.22%, with a bid/cover ratio of 3.2, according to the Bundesbank. The supposedly good news is being offered as a reason for the bounce in European shares and peripheral debt this morning. It was little more than a month ago that the EFSF hoped to have €1T in firepower.

12:32 PM It used to that 10-year Treasurys would never fall through 3%. Now, with the yield straddling 2% for weeks

1:13 PM Amid end-of-year lower volumes, Treasury's reverse their losses as the 10-year auction comes in strong with a huge indirect bid (the group including global central banks). The 30-year yield -0.03 to 3.03%; 10-year sinks below 2%, -0.03 to 1.99%. Maybe you shouldn't count on 10-years cresting 3% anytime soon.

2:20 PM Detail from the FOMC: "Notwithstanding some apparent slowing" globally, the U.S. economy has been expanding moderately. Household spending advancing, but business fixed investment growing "less rapidly." Inflation has moderated since earlier this year. As always lately, panel stands "prepared to employ its tools" to promote recovery.

Should continue to see more downside, by Friday as the ECB President will be speaking for Thurs and Fri market sessions.

1:13 PM Amid end-of-year lower volumes, Treasury's reverse their losses as the 10-year auction comes in strong with a huge indirect bid (the group including global central banks). The 30-year yield -0.03 to 3.03%; 10-year sinks below 2%, -0.03 to 1.99%. Maybe you shouldn't count on 10-years cresting 3% anytime soon.

2:20 PM Detail from the FOMC: "Notwithstanding some apparent slowing" globally, the U.S. economy has been expanding moderately. Household spending advancing, but business fixed investment growing "less rapidly." Inflation has moderated since earlier this year. As always lately, panel stands "prepared to employ its tools" to promote recovery.

Should continue to see more downside, by Friday as the ECB President will be speaking for Thurs and Fri market sessions.

Monday, December 12, 2011

GOOG - Option 630.00 C DEC 11

Two hours before the close we decided to pick up some $GOOG 630.00 DEC 11 C 3.90 x 4.00; which looked interesting here. But, the market was not having any of it. GOOG just bounced around, making us think this was wrong. The high of this option was 4.50; which we thought would be able to see again.

Market started to put in the work and allowed us to take $GOOG 630.00 DEC 11 C out at 4.20. But if held 4.40 could have be achieved, but who want to hold overnight in this environment.

GS - Drop

The rating agencies weighed in on last week's EU deal and didn't see much (I, II), as Europe's ongoing debt debacle and an unexpected guidance cut by Intel sparked a sell-off in stocks before bouncing off the Dow's 200-day MA.

4:49 PM U.K. banks worry about their influence over financial services policies decided in Brussels following PM Cameron's withdrawal from the new EU treaty.

4:41 PM Goldman Sachs (GS) cancels its information session at Penn and reduces the number of student interviews as it seeks to limit hires to those who have previously interned at the bank. With the weak job market, students are more likely than in the past to stick with firms they intern for rather than shop around, limiting the need for Goldman to find new recruits.

Closing near the lows, appears to be more downside to this stock, maybe....

Closing near the lows, appears to be more downside to this stock, maybe....

Sunday, December 11, 2011

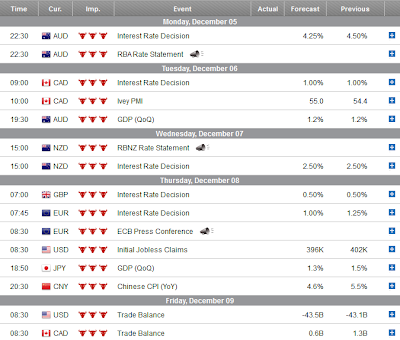

Sunday, December 4, 2011

Saturday, December 3, 2011

BAC - Weekly Options

6:38 PM Bank of America (BAC) is close to its limit on how much stock it's authorized to issue without being forced to go to shareholders to ask for permission, according to a Reuters report. Although it may not be that difficult to do, it does reflect just how much the bank has forced to sell to keep itself afloat. Since 2007, the bank's share float has soared from 4.5B shares to 10.1B, an increase -read dilution of shareholder equity - of nearly 125%.

Subscribe to:

Posts (Atom)

Archive

-

►

2009

(180)

- January (17)

- February (23)

- March (20)

- April (13)

- May (18)

- June (16)

- July (10)

- August (9)

- September (16)

- October (12)

- November (12)

- December (14)

-

►

2010

(210)

- January (20)

- February (32)

- March (17)

- April (25)

- May (33)

- June (4)

- July (10)

- August (2)

- September (20)

- October (16)

- November (15)

- December (16)