Friday, September 30, 2011

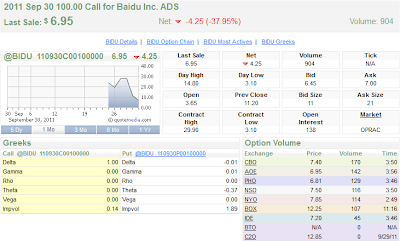

BIDU - Up and Down - OptionEx

2:57 PM Don't worry too much about the Department of Justice joining a probe of U.S.-listed Chinese Internet firms, S&P Scott Kessler says in raising his rating on Baidu (BIDU -2.1%) to Strong Buy. Keep your eyes on the prize: China's 500M-plus users, he says, and Baidu is well positioned given its big search market share and emerging digital offerings.

9:56 AM Chinese Internet stocks continue to plummet following yesterday's reports of DOJ, SEC, and FBI investigations into alleged accounting fraud. BIDU -6.2%. SINA -5.1%. SOHU -6.3%. SNDA -3.7%. YOKU -4.4%. TUDO -8%. RENN -7.5%. MOBI -5.3%. (also)

This market gaped down and this made a run to the upside, however, this was short lived and proceed to move back down, with Chop-fest in mind. As, you can see this company is in the news and is in the process of been investigated. This morning the underlying stock gap down, then made a turnaround. The BIDU 100 SEP C and BIDU 105 C were on the order list.

Also, a shout out @Sangluccitrades Chat room, make a killing this thing.

2nd Play

Late Afternoon the BIDU 105 SEP P were on the order list. Until the late session around 2:30PM ET; this is when the Bond Market closed. And 3rd Qtr end on a down note.

SPY - 3rd Qtr End

12:20 PM Another troubling data point regarding China: CDS spreads for Chinese debt have taken off today, reaching the 200bp level. Meanwhile, UBS is out with a negative report on the country, forecasting GDP growth will decline to 7.7% in Q1, as softening exports have a domino effect on manufacturing, investment, and consumption.

9:46 AM Spreads widen on Morgan Stanley (MS -5.4%) five-year CDS to 455 bp, highest since March 2009. Bank of America’s (BAC -1%) spread also is up 3% to a record 410 bp.

Wednesday, September 28, 2011

SPY - European Decision In The Wings

SPY 111 OCT P open up to 2.00 in change, with it close out by the end of day for 2.85 in change. Ben did speak after the market but it was pretty much the same thing over and over. European decision in the wings and on deck tomorrow. Will have to see how the market reacts and also, EcoNews of Initial Jobs and GDP numbers are out at 8:30AM ET.

GOOG Darkside

GOOG SEP 525 P could have been purchased in the morning. Open Price was 1.45 per contract and end up at the 4.00 per contract by end of day. It was a pretty interesting day, as the market were pretty much in a mixed market mode.

We had thought that the the SPY would rise to 120.00 for Ben after the market, well it went the other way for a 2.00 per contract loss on an SPY SEP 120.00 C contract.

2nd Play

GOOG SEP 530 P should have been purchased, as the market started to slide. This was a entry of at or around 4.10 to get it to run up to the 6.00 per contract level by end of close. Well look at the news at 3:58PM; so basically after the market close.

3:58 PM Samsung's(SSNLF.PK) deal to pay royalties on its Android devices to Microsoft (MSFT -0.4%) is bad news for Google's (GOOG -2%) mobile strategy because it means Android is no longer free, according to Heard On The Street. Now it becomes harder for others to get away without paying, and it narrows the effective price gap with operating systems like Windows Phone.

Monday, September 26, 2011

SPY Monday Reblancing.

Sunday, September 25, 2011

Saturday, September 24, 2011

SPY Strangle?!?!?

SPY OCT Strangle was a late day trade, as we where trying to place a good risk to reward on the ECB and over the weekend news that may come out of Euro.

After review of this trade the call was placed just right and the put side was a poor choice. And here is why. As you can see the SPY 111.00 OCT P is 2 dollars away from being anywhere near the money. Sure you can get out for some money only if the calculated 1.50 dollar come into play.

SPY can sometime be a sweet trading tool, if you set it up too be.

Most of the Sunday night news does not make it into the Monday morning session.

Friday, September 23, 2011

Option Corner – Level Of Concerns for 9/23/2011

This is a test. It is based off the "Level of Concern Indicator." for the day.

Day Support Level - Long (Call)

QQQ 52.00 OCT C

SPY 111.00 OCT C

AAPL 395.00 OCT C

YHOO 13.00 OCT C

INTC 20.00 OCT C

CSCO 14.00 OCT C

ORCL 27.00 OCT C

TEF 17.50 OCT C

Day Resistance Level - Short (Put)

SLV 32.00 OCT Put

GLD 166.00 OCT Put

Any strategies discussed, including examples using actual securities and price data, are strictly for illustrative and educational purposes.

In order to simplify the computations, commission, fees, and margin interest and taxes have not been in included in the examples used in this presentation. These costs will impact the outcome of all stock and options transactions and must be considered prior to entering into any transactions.

Multiple leg options strategies involve additional risks and multiple commissions, and may result in complex tax treatments. Please consult your tax adviser. Implied volatility represents the consensus of the marketplace as to the future level of stock price volatility or the probability of reaching a specific price point. The Greeks represent the consensus of the marketplace as to how the option will react to changes in certain variables associated with the pricing of an option contract. There is no guarantee that the forecasts of implied volatility or the Greeks will be correct.

Market was dead for the whole day and a lot of people, where caught in the middle. Should we sell or Should we buy? Well this question, was neither and just sit on your trading hands was the best of both worlds.

We decided to do a late trade in the SPY with the SPY 115 OCT C and the SPY 111 OCT P.

This created a debit of with an average of 113.00; currently where this market is. ECB should market this market fun over the weekend and pay us out on either side, or just kill the trade with OCT sideways action. We are confident that will make a pretty decent trade come Monday morning.

Month End starts next week, let the games begin.

Sunday, September 18, 2011

1:31 PM Greek PM Papandreou - reportedly in London en route to the U.S. - turns his plane around and returns to Athens.

2:00 PM In a statement, Greek finmin Venizelos denies Papandreou is rushing back to Athens "because there is financial risk or temporary economic event." He urges Greek politicians and press to take care about what they say as those outside the country take loose words about weak government finances and erroneously inflate their importance.

Friday, September 16, 2011

6:10 PM MicroMax. Spice. Tianyu. Those are a few of the hundreds of unknown small cell phone makers that sell more units than Apple, LG and Samsung combined - 153M phones - across the developing world. It's a wild, fragmented market where any number of today's tiny companies could be tomorrow's giants.

3:21 PM Yahoo (YHOO) sees the mobile market as key to improving its search share, and hopes to displace Google (GOOG) as Apple's (AAPL) search partner. NetMarketShare estimates Yahoo, which has struggled with search monetization issues, had a mere 5.6% of the mobile search market in August, compared with Google's (GOOG) 92%.

Wednesday, September 14, 2011

Follow up $EURUSD range consolidation of 1.37384 from 1.37053

$EURUSD short 1.37350 will be looking for 1.37300; $EURUSD short completed.1.37213

Monday, September 12, 2011

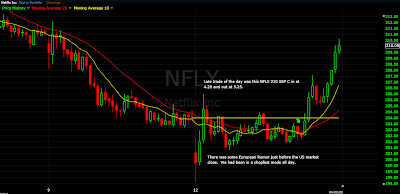

We had a decent day, due to the chop-fest we experienced in the first part of the morning, with AAPL. NFLX was a last mintue thing. NFLX was taken at a Market Gap up and the market pull back, sheeza. Thinking we would have to hold it overnight, which in this market is never fun.

European Rumor surfaced again this market started to rally, NFLX 210 C were under water, came back to life. Now, we do not have to hold overnight, as this position has been closed.

NFLX 210 SEP C 4.20 in

NFLX 210 SEP C 5.25 Out

Other trades

AAPL Long 375 SEP C at the begin; which turned into a Straddle with the AAPL 375 SEP P... Markets were in full chop-fest mode... We did not have any conviction with Obama Speech, which was a re-hashing of the Campaign Job....

LVS Short 46 SEP P this was a dumb move. LVS never moves the way you want is to, with WYNN gaping on deal signing. Small gain, but painful all day, workout.

Sunday, September 11, 2011

Thursday, September 8, 2011

Tuesday, September 6, 2011

GOOG 495 WK P were 2.75 from 2.45

AAPL 365 WK C were 15.80 from 7.35

GLD 183 WK P were 2.64 from 2.64

SDS 25 WK P were .91 from .60

These trades were for the working man, as this market made you sit through a lot of chop-fest.

Monday, September 5, 2011

So I put it to you guys… Why do YOU think our regulators can’t prove what they set out to? Do YOU think our equity markets should undergo further regulations? If so, what regulations would you like to see?

The U.S. financial-services industry is poised for a massive regulatory overhaul following the financial meltdown and the Bernard Madoff Ponzi scheme, among others. The regulator has been criticized for its failed oversight of Wall Street and may lose some of its powers. The Obama administration has been planning a new consumer-protection agency, which suggests turf battles that are likely to lie ahead. The SEC is one of the federal agencies most at risk in the regulatory revamp under study by the administration and Congress, according to The Wall Street Journal.

SEC Mission Statement

The mission of the U.S. Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

The laws and rules that govern the securities industry in the United States derive from a simple and straightforward concept: all investors, whether large institutions or private individuals, should have access to certain basic facts about an investment prior to buying it, and so long as they hold it. To achieve this, the SEC requires public companies to disclose meaningful financial and other information to the public. This provides a common pool of knowledge for all investors to use to judge for themselves whether to buy, sell, or hold a particular security. Only through the steady flow of timely, comprehensive, and accurate information can people make sound investment decisions.

This is an overview of the SEC's history, responsibilities, activities, organization, and operation.

The last time I checked there were currently 3,000 employees of the SEC and with approximately 8,000 listed issues (excluding European Structured Products) from more than 55 countries, NYSE Euronext's equities markets—the New York Stock Exchange, NYSE Euronext, NYSE Amex, NYSE Alternext and NYSE Arca—represent one-third of the worlds equities trading and the most liquidity of any global exchange group. NASDAQOMX.COM We are the world’s leading provider of surveillance serving 24 exchanges worldwide, 50 brokers in 35 countries and 6 regulators.

In the midst of an internal overhaul to sharpen the teeth of the agency, the agency is overhauling the enforcement division, carving out five special units with the aim of turning some employees into specialists.

The units are: asset management (covering mutual funds, hedge funds, private-equity firms, investment advisers and investment companies); market abuse (such as insider trading); structured and new products; foreign corrupt practices; and municipal securities and public pensions.

The way I read this is that the SEC is dealing with the Mutual Funds first and Insider Trading second. Frank-Dodd bill was only a series of rules to deal with the Hedge Funds and New Products.

The SEC also recently created the RiskFin division and the Office of Market Intelligence to handle tips and referrals. It's also creating a group for inspecting clearing agencies. The agency's goals face substantial hurdles in the form of constrained budgets and aging technologies. SEC is recruiting industry professionals with expertise in trading, risk assessment and compliance for its Office of Compliance Inspections and Examinations. Even amid the changes, its enforcement staff is adding attorneys, trial staff and technology positions. The agency's annual turnover rate dropped to under 4% in 2009 from more than 6% the previous year.

Look at the SEC Job Opportunities, this list contains Attorneys first and Market Abuse Analysis and Detection Center last.

Attorneys , Examiners , Accountants , Economists , Industry Professionals , Senior Officers , Support Professionals , Paralegals , Information Technology , Students , Market Abuse Analysis and Detection Center

The SEC is an governmental law firm, In law its not about the many cases you have one or lost. Its about the billable hours on the books. Lawyers can recite the laws, but can not enforce them. This is why you are seeing company go through Arbitration.

The SEC’s careers portal offers detailed info on career paths, including attorneys, compliance examiners, accountants and economists.

Looking Toward Your Future at the SEC Quality of Work & Life http://www.sec.gov/jobs/jobs_worklife.shtml

SEC Federal Benefits http://www.sec.gov/jobs/jobs_benefits.shtml It emphasizes a work/life balance with perks such as flex hours. And of course working for Uncle Sam yields excellent employee benefits.

Jeff Risinger: The U.S. Security and Exchange Commission - Interview with HR Insider – Apr 26, 2010 http://www.fins.com/Finance/Articles/SB124577160661942209/Jeff-Risinger-The-U-S-Security-and-Exchange-Commission?Type=2&idx=2

Sunday, September 4, 2011

MASTER REPURCHASE AGREEMENT

This is a MASTER REPURCHASE AGREEMENT, dated as of November 30, 2006, between NEW CENTURY MORTGAGE CORPORATION, HOME123 CORPORATION, NEW CENTURY CREDIT CORPORATION, NC CAPITAL CORPORATION (each a "Seller" and collectively, the "Sellers") and NEW CENTURY FINANCIAL CORPORATION (the "Guarantor") and GOLDMAN SACHS MORTGAGE COMPANY, a New York limited partnership (the "Buyer").

The Housing Markets collapsed, was based on Master Repurchase Agreement, Wet-Ink Loans, and Over-Stated Income.

Master Repurchase Agreements – The Banks and Mortgage Companies used master repurchase agreements (“Master Repurchase Agreements”) and their own working capital to fund the origination and purchase of mortgage loans and to hold these loans pending sale or securitization.

How does this work: The Master Repurchase Agreements typically provided that the Seller would sell mortgage loans to a “Repurchase Counter-Party” and commit to repurchase these loans on a specified date for the same price paid, plus a fee for the time value of money, termed a “Price Differential.” The Price Differential was specified in a pricing side letter and was generally set at a floating rate based on LIBOR – London Interbank Offered Rate, plus a spread.

This Repurchase Agreement is not a commitment by the Buyer to enter into Transactions with the Sellers but rather sets forth the procedures to be used in connection with periodic requests for the Buyer to enter into Transactions with the Sellers. The Sellers hereby acknowledge that the Buyer is under no obligation to agree to enter into, or to enter into, any Transaction pursuant to this Repurchase Agreement. Each such transaction shall be referred to herein as a "Transaction" and shall be governed by this Repurchase Agreement, unless otherwise agreed in writing.

Under the Master Repurchase Agreements, in the event of default, each of the Repurchase Counter-parties had a right to accelerate the Seller's obligations to repurchase the loans subject to the facility. If the Seller did not pay those repurchase obligations, the agreements generally provided that the Repurchase Counter-parties could sell the mortgage loan to third parties (often on short notice) or retain the mortgage loans for their own account and credit the value of the mortgage loans against the Seller's repurchase obligation (termed a “buy-in”), in effect foreclosing the Sellers right to repurchase such mortgage loans.

Notice of Repurchase and Termination of Transactions - An Agreement to require the Company and/or its subsidiaries to satisfy their obligation to repurchase all outstanding mortgage loans financed under the Master Repurchase. The letters also purport to accelerate the obligation. Company has received notices from certain of its lenders asserting that the Company and/or its subsidiaries have violated their respective obligations under certain of these financing arrangements and that such violations amount to events of default. Certain of these lenders have further advised the Company that they are accelerating the Company's obligation to repurchase all outstanding mortgage loans financed under the applicable agreements. Below is a summary of the Company's financial obligations that are purported to have been accelerated by the Company's lenders as well as a description of certain additional notices received by the Company from its lenders.

How does this work: This in effect created a margin calls.

"Wet-Ink Mortgage Loan" shall mean a Mortgage Loan which a Seller is selling to the Buyer simultaneously with the origination thereof by such Seller and for which the Mortgage Loan Documents have not been delivered to the Custodian.

"Wet-Ink Trust Receipt" shall mean a trust receipt issued by the Custodian evidencing Purchased Mortgage Loans which are Wet-Ink Mortgage Loans, substantially in the form attached to the Custodial Agreement.

Borrowers hit with a Margin Call - Foreclosure

When the margin posted in the margin account is below the minimum margin requirement, the broker or exchange issues a margin call. The investors now either have to increase the margin that they have deposited or close out their position. They can do this by selling the securities, options or futures if they are long and by buying them back if they are short. But if they do none of these, then the broker can sell their securities to meet the margin call.

This situation most frequently happens as a result of an adverse change in the market value of the leveraged asset or contract. It could also happen when the margin requirement is raised, either due to increased volatility or due to legislation. In extreme cases, certain securities may cease to qualify for margin trading; in such a case, the brokerage will require the trader to either fully fund their position, or to liquidate it.

Archive

-

►

2009

(180)

- January (17)

- February (23)

- March (20)

- April (13)

- May (18)

- June (16)

- July (10)

- August (9)

- September (16)

- October (12)

- November (12)

- December (14)

-

►

2010

(210)

- January (20)

- February (32)

- March (17)

- April (25)

- May (33)

- June (4)

- July (10)

- August (2)

- September (20)

- October (16)

- November (15)

- December (16)