Saturday, December 31, 2011

US Market TimeLine for Options

This is should give you some insight to the workings of the markets as a whole. The adrenaline rush generally last until 10:00 or 10:30 A.M. As, the most intense action in the market happens right when it opens. Nonetheless, options traders will be better prepared, That's it. No fancy stuff.

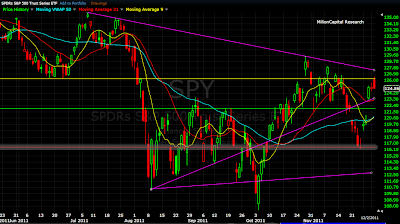

Chart was revised with Red line Boxes to an Option Traders standard. Basic chart was created by by Jerome "Mel" Hickerson is a technical analyst who uses software-generated analysis of breadth and institutional buying to trigger his signals for day trading indices and ETFs.

Thursday, December 29, 2011

GLD - 149.00 DEC C

7:01 AM Gold continues its late-year slide, off 2.4% to $1,526/oz., the lowest price since early July. Off 3.6% to $26.28, silver has returned to its low for the year.

AMZN - 170.00 DEC Call

7:22 AM Goldman's Heather Bellini suggests Amazon (AMZN) could miss consensus revenue forecasts of $18.19B (up 40%). The firm however, maintains its Neutral rating and $190 price target.

General Market Observation

Wednesday, December 28, 2011

EURUSD

PT are the Red and Purple lines..

GS = EURO

Today - Wednesday, December 28, 11:43 AM Europe closes at session lows, knocked for a loop by a rapid dive in the euro (to be fair, cable dropping right alongside), which began around 9 AM ET. Stoxx 50 -1.6%, Germany -1.9%, France -1.1%, Italy -0.7%, Spain -2%, U.K. flat. The euro continues to slide, -1.2% at $1.2920. Cable -1.2% at $1.5476.

The euro tumbled to 15-month lows after the ECB reported European banks had deposited a record amount. Financials were among the weakest stock sectors; commodities were clobbered. NYSE declining issues outnumbered advance's four to one.

Tuesday, December 27, 2011

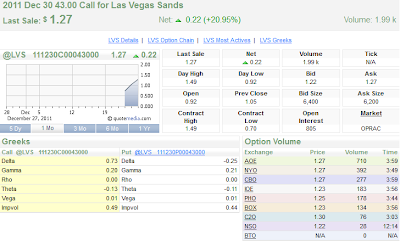

LVS - Lotto Option Play

This a mover on some Govt news, that the Obama Administration; new interpretation, by the department's Office of Legal Counsel, said the Wire Act applies only to bets on a "sporting event or contest," not to a state's use of the Internet to sell lottery tickets to adults within its borders or abroad.

"The United States Department of Justice has given the online gaming community a big, big present," said I. Nelson Rose, a gaming law expert at Whittier Law School who consults for governments and the industry."

Sunday, December 25, 2011

Saturday, December 24, 2011

Extending the Extended

10:09 AM The House has approved the 2-month payroll tax cut extension. The bill now goes to the President for signing. As part of the bill, President Obama is forced to make a decision within 60 days on whether or not to approve construction of TransCanada's (TRP +1.1%) 1.7K mile pipeline.

Saturday, December 17, 2011

SINA - Rebound - Options Weekly

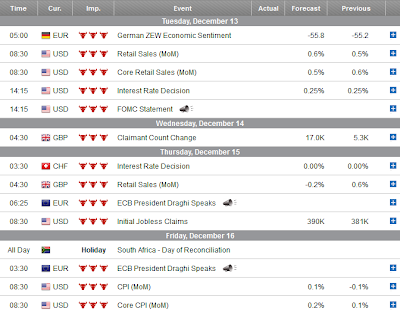

Tuesday, December 13, 2011

GS - OTM DEC 90 P

7:55 AM The EFSF sells €1.97B in 3 month paper priced to yield 0.22%, with a bid/cover ratio of 3.2, according to the Bundesbank. The supposedly good news is being offered as a reason for the bounce in European shares and peripheral debt this morning. It was little more than a month ago that the EFSF hoped to have €1T in firepower.

1:13 PM Amid end-of-year lower volumes, Treasury's reverse their losses as the 10-year auction comes in strong with a huge indirect bid (the group including global central banks). The 30-year yield -0.03 to 3.03%; 10-year sinks below 2%, -0.03 to 1.99%. Maybe you shouldn't count on 10-years cresting 3% anytime soon.

2:20 PM Detail from the FOMC: "Notwithstanding some apparent slowing" globally, the U.S. economy has been expanding moderately. Household spending advancing, but business fixed investment growing "less rapidly." Inflation has moderated since earlier this year. As always lately, panel stands "prepared to employ its tools" to promote recovery.

Should continue to see more downside, by Friday as the ECB President will be speaking for Thurs and Fri market sessions.

Monday, December 12, 2011

GOOG - Option 630.00 C DEC 11

Two hours before the close we decided to pick up some $GOOG 630.00 DEC 11 C 3.90 x 4.00; which looked interesting here. But, the market was not having any of it. GOOG just bounced around, making us think this was wrong. The high of this option was 4.50; which we thought would be able to see again.

Market started to put in the work and allowed us to take $GOOG 630.00 DEC 11 C out at 4.20. But if held 4.40 could have be achieved, but who want to hold overnight in this environment.

GS - Drop

The rating agencies weighed in on last week's EU deal and didn't see much (I, II), as Europe's ongoing debt debacle and an unexpected guidance cut by Intel sparked a sell-off in stocks before bouncing off the Dow's 200-day MA.

Closing near the lows, appears to be more downside to this stock, maybe....

Sunday, December 11, 2011

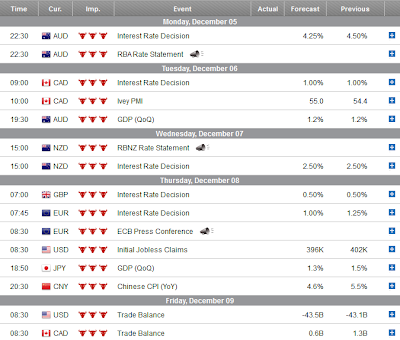

Sunday, December 4, 2011

Saturday, December 3, 2011

BAC - Weekly Options

Sunday, November 20, 2011

Saturday, November 19, 2011

CRM - After Earnings Announcement

In make a play after the earnings announcement its a test of ones skill, as in life. Most options player love the fact that they enter an stock underlying before the announcement, but only to find that the where right in the direction.

However, the IV in the option sux out the premiums and you mostly found yourself on the losing side of the earnings play. Well the above was to take a position after the earnings.

As you can see, CRM still had downward pressure on the earnings announcement that this weekly option play paid you out.

50 x .55 = $2,800 debit

50 x 1.60 = $5,000 credit

or

10 x .55 = $500 debit

10 x 1.60 =$1,000 credit

Disclaimer: Friday Weekly - Options are not for the faint at heart, you are fight for this market not to break your bank... Risk on fund you're able to loss and keep your losses small.

BIDU - Weekly OptionsEx

SPY - Flat Liner

Friday, November 18, 2011

XOM - Mid Day Scan

Thursday, November 17, 2011

SPY - Waterfall

Tuesday, November 15, 2011

Monday, November 14, 2011

AAPL - Drop?

- 7:44 AM The first reviews for Amazon's (AMZN) Kindle Fire are ambivalent. "The Fire does not have anything like the polish or speed of an iPad (AAPL)," says the NYT's David Pogue. Engadget calls the device "a great value," and loves its content integration, but also writes, "When stacked up against other popular tablets, the Fire can't compete."

- Sunday 8:37 AM While "the pricey Android" guys are likely to feel the immediate brunt of the $199 Kindle Fire (AMZN), Brooke Crothers believes the iPad (AAPL) will be vulnerable in the longer term. The impact is "as inevitable as the $999 MacBook Air," which began life in the $1,800-$3,000 range.

Friday, November 11, 2011

CAT - Weekly Play

Wednesday, November 9, 2011

GS vs Italy

9:32 AM In a 10-Q filing today, Goldman Sachs (GS -3.9%) discloses that AIG has threatened to sue over its MBS dealings with the firm. Goldman also raises its expectations of costs stemming from mortgage-related lawsuits from $485M to $15.8B.

Saturday, November 5, 2011

JEF - To Big Fail or To Big To Hedge

Monday Nov 7th - Earnings Release

Priceline.com Incorporated (PCLN) is a global online travel company that offers its customers a range of travel services, including the opportunity to purchase hotel room reservations, car rentals, airline tickets, vacation packages, cruises and destination services in a price-disclosed manner.

This is company has a confirmed earnings release on 11/07/2011 at 4:05 PM ET, After Close with no scheduled Conference Call . This will be a news-maker and whom will benefit from this news-maker.

Look at the Related companies in this companies sector. They are Expedia, Inc. (EXPE) and Travelzoo, Inc. (TZOO).

DISH Network Corporation (DISH) is a pay-television provider, with approximately 14.133 million customers across the United States as of December 31, 2010.

This is company has a confirmed earnings release on 11/07/2011 at 6:00 AM ET, Before Open with a Conference Call scheduled for 12:00 PM ET. This will be a news-maker and whom will benefit from this news-maker.

Look at the Related companies in this companies sector. They are Netflix, Inc. (NFLX) and DIRECTV (DTV).

Thursday, November 3, 2011

News Maker Sympathy - Option InPlay

Qualcomm among gainers as tech stocks rise

(9:48 AM ET) SAN FRANCISCO (MarketWatch) -- Tech stocks claimed the high ground in early trading Thursday, with Qualcomm Inc. QCOM +0.14% up $3.62 a share, or 7%, at $55.87 following its upbeat quarterly results. Storage-memory developer Fusion-io Inc. FIO +0.85% also performed well, rising $22.4 a share, or 7%, to $34.12 after it swung to a quarterly profit.

Based off this News-marker - Weekly Option InPlay

CBS profit climbs 38% on streaming fees, ad sales

(4:11 PM ET) CHICAGO (MarketWatch) -- CBS Corp. CBS -2.12% said Thursday its third-quarter profit rose 38% on increased international syndication sales, primetime advertising sales and streaming video licensing fees from Netflix Inc. NFLX -0.21% and Amazon.com Inc. AMZN -0.12% , topping most Wall Street forecasts. The entertainment giant said it earned $338 million, or 50 cents a share, on sales of $3.37 billion, compared with a profit of $245 million, or 35 cents a share, on revenue of $3.30 billion in the same period last year. Analysts polled by FactSet Research were expecting a profit of 46 cents a share on revenue of $3.44 billion.

Based off this News-marker - NFLX 90 NOV WK C 2.95 from .53

Wednesday, November 2, 2011

Archive

-

►

2009

(180)

- January (17)

- February (23)

- March (20)

- April (13)

- May (18)

- June (16)

- July (10)

- August (9)

- September (16)

- October (12)

- November (12)

- December (14)

-

►

2010

(210)

- January (20)

- February (32)

- March (17)

- April (25)

- May (33)

- June (4)

- July (10)

- August (2)

- September (20)

- October (16)

- November (15)

- December (16)