Ticker Company Current Price as of 4/30/09

CSCO Cisco Systems, Inc. 19.32

WMT Wal-Mart Stores Inc. 50.4

AMAT Applied Materials Inc. 12.21

HPQ Hewlett-Packard Company 35.98

HD The Home Depot, Inc. 26.32

CHK Chesapeake Energy Corporation 19.71

AES The AES Corporation 7.07

BRCD Brocade Communications Systems, Inc. 5.78

CVX Chevron Corp. 66.1

M Macy's, Inc. 13.68

CVS CVS Caremark Corporation 31.78

LOW Lowe's Companies Inc. 21.5

DYN Dynegy Inc. 1.78

DTV DIRECTV Group, Inc. 24.73

EP El Paso Corp. 6.9

SYMC Symantec Corporation 17.25

Is a private-equity research firm. The charts provided here are not meant for investment purpose(s) and only serve as technical examples. Trader Disclosure: See below for our Legal / Disclaimer.

Thursday, April 30, 2009

XOM - Sell To Close and GS Update

Well late updated on XOM, we had a wonderful two day rally into earnings and Sell to Close yesterday all calls positions. XOM reported net down 58% on lower oil prices and 1st-qtr profit down 58 pct. This why you never holding into earnings. Could have straddled with the puts the day before the annoucement, however, it was a great trade.

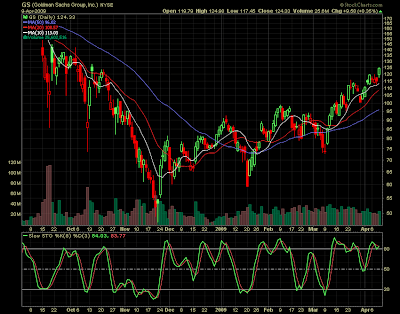

GS - Bouncing like a rubber ball in a PinBall machine game. It appears we have closed our gap from the April 14 earnings drop this afternoon, we are currently at this time in writing we are heading lower.

GS - Bouncing like a rubber ball in a PinBall machine game. It appears we have closed our gap from the April 14 earnings drop this afternoon, we are currently at this time in writing we are heading lower.

Tuesday, April 28, 2009

XOM - Earnings Announcement Due Apr 30 Before Market

Earnings are due out for this oil company on Thursday, there has been a nice earnings running up. Only play them when the overall markets are trending up or up days. As this company is slow moving in the options department.

Call 09 May 65.00 (XOM EM-E) 3.08 +0.59 2.98 3.05 682 16711

Put 09 May 65.00 (XOM QM-E) 1.26 -0.49 1.26 1.30 786 23086

Call 09 May 70.00 (XOM EN-E) 0.65 +0.14 0.62 0.65 2121 29577

Put 09 May 70.00 (XOM QN-E) 4.05 -0.70 4.00 4.10 486 6522

GS - WTF

Well there has been no news as, in good news for this financial sector company. It has been in a sideways trading range for the past couple of weeks. May we should hear some more news on the Financial "Stress Test" which we now believe will not be as effective to this company as we anticipated in the beginning. Two more trading days left in April. $120 to $123 range bound.

Well there has been no news as, in good news for this financial sector company. It has been in a sideways trading range for the past couple of weeks. May we should hear some more news on the Financial "Stress Test" which we now believe will not be as effective to this company as we anticipated in the beginning. Two more trading days left in April. $120 to $123 range bound.Saturday, April 18, 2009

GS - Weekly ANALsys

This is a snap shot of the Goldman Sachs weekly chart end April 18, 2009. As we can see GS ran into its 50-Day moving average, but did not hold. As we look forward to the next couple of weeks with some news from the "Bank Stress Test". Will we see $102 price level for GS? Heavy resistance at 124-125 level GS is still hang on. At the time of this writing a few more banks were taken over this weekend and 2 smaller banks have repaid there TARP Fund Bailout money back, per the Treasury reports. Tech: MA are all in an uptrend, however, Stochastics are in an oversold position - note with the light volume were are having indicators are more likely to produce a false positive. Keep your powder dry, go hunting!

This is a snap shot of the Goldman Sachs weekly chart end April 18, 2009. As we can see GS ran into its 50-Day moving average, but did not hold. As we look forward to the next couple of weeks with some news from the "Bank Stress Test". Will we see $102 price level for GS? Heavy resistance at 124-125 level GS is still hang on. At the time of this writing a few more banks were taken over this weekend and 2 smaller banks have repaid there TARP Fund Bailout money back, per the Treasury reports. Tech: MA are all in an uptrend, however, Stochastics are in an oversold position - note with the light volume were are having indicators are more likely to produce a false positive. Keep your powder dry, go hunting!Friday, April 17, 2009

In May Does It Rain in Spain?

It was already clarified by the Treasury that the result of the test will not be "pass" or "fail" but rather, "How much capital does this bank need in order to meet the credit needs of its borrowers?"Earlier there were reports that the Treasury may not release the results of the individual banks so as to avoid any nervousness in the markets.

Also there are concerns that the "worst case scenario" used in the stress test is not "worst" enough, and thus the projected capital requirements may rather be understated.With the results for the first quarter and the stress tests, investors will be in a much better to distinguish between the healthy banks and the weaker ones.

While some of the smaller banks have already repaid TARP funds, some other bigger ones will repay after the stress tests show that they do not need federal funds.

Goldman Sachs has already launched a $5 billion offering of common shares to the public, the proceeds of which will be used to repay TARP funds.At the same time, as the recent results of the some of the banks have shown, the losses in consumer and commercial real estate loan portfolios have risen sharply in the last quarter, in addition to the housing loan losses, and we suspect that many banks will be required to raise capital soon after the stress test results

Also there are concerns that the "worst case scenario" used in the stress test is not "worst" enough, and thus the projected capital requirements may rather be understated.With the results for the first quarter and the stress tests, investors will be in a much better to distinguish between the healthy banks and the weaker ones.

While some of the smaller banks have already repaid TARP funds, some other bigger ones will repay after the stress tests show that they do not need federal funds.

Goldman Sachs has already launched a $5 billion offering of common shares to the public, the proceeds of which will be used to repay TARP funds.At the same time, as the recent results of the some of the banks have shown, the losses in consumer and commercial real estate loan portfolios have risen sharply in the last quarter, in addition to the housing loan losses, and we suspect that many banks will be required to raise capital soon after the stress test results

GS and Sector Map

There is still a tug a war in the financial sector (mixed) signals. The following was a precusor to the following pop and drop and pop with a touch of fade. Market was not to happy that GS was a little greedy with TARP and now they want to pay it off and keep bonuses in tact.

There is still a tug a war in the financial sector (mixed) signals. The following was a precusor to the following pop and drop and pop with a touch of fade. Market was not to happy that GS was a little greedy with TARP and now they want to pay it off and keep bonuses in tact.The Goldman Sachs Group, Inc. announced that it has priced a public offering of 40,650,407 shares of its common stock at a price to the public of $123 per share for total gross proceeds of approximately $5 billion. Bad News - Dropped the stock below it's offering price. Warren Buffets price level from last couple of months.

The Goldman Sachs Group, Inc. announced that it has declared a dividend of $0.35 per common share to be paid on June 25, 2009 to common shareholders of record on May 26, 2009. The Board also declared dividends of $234.38, $387.50, $250.00 and $250.00 per share of Series A Preferred Stock, Series B Preferred Stock, Series C Preferred Stock and Series D Preferred Stock, respectively (represented by depositary shares, each representing a 1/1,000th interest in a share of preferred stock), to be paid on May 11, 2009 to preferred shareholders of record on April 26, 2009. In addition, the Board declared dividends of $2,500 per share of Series G Preferred Stock to be paid on May 11, 2009 to preferred shareholders of record on April 25, 2009 and dividends of $12.50 per share of Series H Preferred Stock to be paid on May 15, 2009 to preferred shareholders of record on April 30, 2009.

Wednesday, April 15, 2009

Day Trading Time Zones

The opening bell - 9:30am to 9:50am

The first 20 minutes of the day are the most volatile of the trading day. While this is the most dangerous day trading time zone, it can also provide to be the most lucrative if you understand how to trade in this time frame. It is usually recommended that novice traders stay out of this zone and wait for the imbalances created from overnight news or earnings releases to settle down. Many technical indicators do not work well in this time frame as the volatility is too strong. In most cases, volume will also be the highest of the day during this time.

The Morning Reversal- 9:50am to 10:10am

The first reversal zone of the day begins at around 9:50am and lasts for 20 minutes. This is a very important period of the day for day traders. I look for this time zone to put on continuation trades. For example, a stock may gap down by 10% on the open and then bounce for 10 to 15 minutes coming into this time zone. However, this is where day traders will look for a reversal of the bounce and a continuation in the primary trend. Once the dust has settled from the opening bell, you will be able to more clearly see what the traders in this security will want to do. Volume will drop off a little bit compared to the open but will still be very high during this day trading time zone. This time period is my favorite for trading as the price stability returns to the market but volatility is still present for profitable trading. In strongly trending markets, reversals may be small or non-existent

Low Risk Trading - 10:10am to 10:25am

During this day trading time zone, volatility shrinks again and you want to look for clues in the Dow, S&P, and Nasdaq as to the direction that the market wants to take. This is an opportune time for bigger traders to move the market the way they choose. Watch the tape of the stocks that you track for any indications of direction.

Decision Time - 10:25am to 10:30am

The market will be settled for the most part and most of the days volatility will have passed. There may have been a few reversals in the first hour but during this small zone, many traders will cash out of profitable positions and finish the day while others will position themselves for the next move in the market. I look at this period as a time for consolidation and preparation. The move following this day trading time zone can last until lunchtime.

Final Move of the Morning - 10:30am to 11:15am

This time zone will be the final major time zone as far as morning trading is concerned. It is safer in relation to the other zones in that technical indicators such as the slow stochastic or RSI will have a more pronounced effect than some of the earlier time zones. Be careful near the end of this range as it leads right into the lunch time hour which can start early or start late. A rule of thumb is that the more volatile the preceding day trading time zones are, the greater the chance that this move will extend further into the 11 o'clock hour.

Go Eat your Lunch!! - 11:15am - 2:15pm

Lunchtime trading can be brutal. False breakouts and choppy sideways moves characterize this time period. If you must trade, trade lightly until you have a good track record of putting on winning trades in this time zone. Also, please let me know how you do it! The risk to reward is very high here. Volume will fall out of the market as floor traders and other institutional traders will take their lunches. Don't let this time zone turn profitable morning trading into a loss.

Back to Business - 2:15pm - 3:00pm

Traders will work their way back into the market during this time frame. For the most part, trends have been established and trading during this timeframe will provide you with opportunities where the use of technical indicators is applicable. Remember, the CME closes at 3pm so you will see a pickup in volume due to some of the bond traders coming into the equity and futures markets.

It's GO Time - 3:00pm - 3:10pm

Bond market closes and bond traders will flood the equities markets; watch for sharp moves in either direction. Moves can be fast and large.

Use Caution & Stay with the Trend - 3:10pm - 3:25pm

During this day trading time zone, use caution as you are approaching the 3:30pm timeframe which tends to produce a reversal or a stall of the prior trend. During this zone, you want to stay with the trend that has been established from the 2:15pm and even 3:00pm timeframe but don't get attached to the positions.

Portfolio Re-balancing - 3:30pm - 4:00pm

I tend to recommend traders not trade during the last half hour of the day. There are many funds and institutions rebalancing their portfolios and it can get a bit tricky. If your day trading, you only have 30 minutes max to get out of your trade and I don't like working under that type of pressure. If your an action junkie or like putting on very short term trades, the volatility is there for you to do so.

As you can see, the chart setup or systems that you look at are not the only factor in putting a day trade on. Remember, day trading is not absolute; it is a game of odds. Your job is to put the odds in your favor and by utilizing the different day trading time zones that we have discussed, your trading will become more consistent.

The first 20 minutes of the day are the most volatile of the trading day. While this is the most dangerous day trading time zone, it can also provide to be the most lucrative if you understand how to trade in this time frame. It is usually recommended that novice traders stay out of this zone and wait for the imbalances created from overnight news or earnings releases to settle down. Many technical indicators do not work well in this time frame as the volatility is too strong. In most cases, volume will also be the highest of the day during this time.

The Morning Reversal- 9:50am to 10:10am

The first reversal zone of the day begins at around 9:50am and lasts for 20 minutes. This is a very important period of the day for day traders. I look for this time zone to put on continuation trades. For example, a stock may gap down by 10% on the open and then bounce for 10 to 15 minutes coming into this time zone. However, this is where day traders will look for a reversal of the bounce and a continuation in the primary trend. Once the dust has settled from the opening bell, you will be able to more clearly see what the traders in this security will want to do. Volume will drop off a little bit compared to the open but will still be very high during this day trading time zone. This time period is my favorite for trading as the price stability returns to the market but volatility is still present for profitable trading. In strongly trending markets, reversals may be small or non-existent

Low Risk Trading - 10:10am to 10:25am

During this day trading time zone, volatility shrinks again and you want to look for clues in the Dow, S&P, and Nasdaq as to the direction that the market wants to take. This is an opportune time for bigger traders to move the market the way they choose. Watch the tape of the stocks that you track for any indications of direction.

Decision Time - 10:25am to 10:30am

The market will be settled for the most part and most of the days volatility will have passed. There may have been a few reversals in the first hour but during this small zone, many traders will cash out of profitable positions and finish the day while others will position themselves for the next move in the market. I look at this period as a time for consolidation and preparation. The move following this day trading time zone can last until lunchtime.

Final Move of the Morning - 10:30am to 11:15am

This time zone will be the final major time zone as far as morning trading is concerned. It is safer in relation to the other zones in that technical indicators such as the slow stochastic or RSI will have a more pronounced effect than some of the earlier time zones. Be careful near the end of this range as it leads right into the lunch time hour which can start early or start late. A rule of thumb is that the more volatile the preceding day trading time zones are, the greater the chance that this move will extend further into the 11 o'clock hour.

Go Eat your Lunch!! - 11:15am - 2:15pm

Lunchtime trading can be brutal. False breakouts and choppy sideways moves characterize this time period. If you must trade, trade lightly until you have a good track record of putting on winning trades in this time zone. Also, please let me know how you do it! The risk to reward is very high here. Volume will fall out of the market as floor traders and other institutional traders will take their lunches. Don't let this time zone turn profitable morning trading into a loss.

Back to Business - 2:15pm - 3:00pm

Traders will work their way back into the market during this time frame. For the most part, trends have been established and trading during this timeframe will provide you with opportunities where the use of technical indicators is applicable. Remember, the CME closes at 3pm so you will see a pickup in volume due to some of the bond traders coming into the equity and futures markets.

It's GO Time - 3:00pm - 3:10pm

Bond market closes and bond traders will flood the equities markets; watch for sharp moves in either direction. Moves can be fast and large.

Use Caution & Stay with the Trend - 3:10pm - 3:25pm

During this day trading time zone, use caution as you are approaching the 3:30pm timeframe which tends to produce a reversal or a stall of the prior trend. During this zone, you want to stay with the trend that has been established from the 2:15pm and even 3:00pm timeframe but don't get attached to the positions.

Portfolio Re-balancing - 3:30pm - 4:00pm

I tend to recommend traders not trade during the last half hour of the day. There are many funds and institutions rebalancing their portfolios and it can get a bit tricky. If your day trading, you only have 30 minutes max to get out of your trade and I don't like working under that type of pressure. If your an action junkie or like putting on very short term trades, the volatility is there for you to do so.

As you can see, the chart setup or systems that you look at are not the only factor in putting a day trade on. Remember, day trading is not absolute; it is a game of odds. Your job is to put the odds in your favor and by utilizing the different day trading time zones that we have discussed, your trading will become more consistent.

Saturday, April 11, 2009

My typical morning is easy, low stress, and somewhat predictable. My kind of trading! A typical trading day goes like this: I am up by 5:45 am Pacific Time. I flip on Bloomberg for the first hour of the market open and then it is turned off (exception: FED MEETING, PRESIDENT SPEECHES, Major Events). . . As most know these marjor events are at or around 10AM EST. But some come after lunch 2PM EST. By the time the markets open at 6:30 a.m. I am at my computer. I do no research before the market opens, but I like to look for overnight news that might get the market moving. A moving market in either direction is good for my trading system. On my screen I have a one-minute chart of the current month emini S&P futures contract with plain price bars, no indicators or oscillators. Around 6:40, the first pattern usually appears and I get ready to trade. By 6:45 I am in a trade and by 6:50, or sooner, I am out. Some time after 6:50, a second pattern usually appears and shortly thereafter I am in the second trade. Usually by 7:15 I am out.

Most of the time I end up with a profit, but to be honest, some times I take a loss. I have learned to accept losses as a part of trading (tutition paid in full). From losses I learn the most about my emotions and how they adversely affect my trading. And, because of these losses I am motivated to continually improve my trading. But for the most part I take a profit when it is given most of the time. I'm am an an active trader, so some of you know that you must take'em if you got them!

Options trading with DTIM offers a combination of your best leverage with minimal premium decay, which leads us to our next tip. Be careful which series you purchase. Okay, you've found a stock at a support level and you want to buy some calls or puts options. Which ones do you buy? Do you buy at the money? Out of the money? Deep in the money? For our style of trading, we like to look at 1 to 2 strike prices in the money. For example, if we are looking at puts on KSS (Kohls) and it is at $62.00, we will mostly likely buy the 65 puts. In the above KSS example, let's say that it is September 15. The September option series will expire in a week (the third Friday of every month). Do you buy the September series or go the next month out and buy October? In this instance we would go out the next month and buy October. With short term option trading, you generally want to stick to the near month option series until you get about two weeks from expiration. At this point it is a good idea to start looking out at the next month. If you are wrong on an option that expires in two days, the premium will disappear faster than you can type in your panic sell order.

I know you really want to know how much can be made in a typical day. It varies, depending on the morning action. Quiet days will produce modest results, while big news over night will increase the action and therefore the profit potential.

Successful traders take time off from trading. Before and After (PnL). Take a week off every quarter and regain your objectivity.

Most of the time I end up with a profit, but to be honest, some times I take a loss. I have learned to accept losses as a part of trading (tutition paid in full). From losses I learn the most about my emotions and how they adversely affect my trading. And, because of these losses I am motivated to continually improve my trading. But for the most part I take a profit when it is given most of the time. I'm am an an active trader, so some of you know that you must take'em if you got them!

Options trading with DTIM offers a combination of your best leverage with minimal premium decay, which leads us to our next tip. Be careful which series you purchase. Okay, you've found a stock at a support level and you want to buy some calls or puts options. Which ones do you buy? Do you buy at the money? Out of the money? Deep in the money? For our style of trading, we like to look at 1 to 2 strike prices in the money. For example, if we are looking at puts on KSS (Kohls) and it is at $62.00, we will mostly likely buy the 65 puts. In the above KSS example, let's say that it is September 15. The September option series will expire in a week (the third Friday of every month). Do you buy the September series or go the next month out and buy October? In this instance we would go out the next month and buy October. With short term option trading, you generally want to stick to the near month option series until you get about two weeks from expiration. At this point it is a good idea to start looking out at the next month. If you are wrong on an option that expires in two days, the premium will disappear faster than you can type in your panic sell order.

I know you really want to know how much can be made in a typical day. It varies, depending on the morning action. Quiet days will produce modest results, while big news over night will increase the action and therefore the profit potential.

Successful traders take time off from trading. Before and After (PnL). Take a week off every quarter and regain your objectivity.

Economic News and Events

Apr 14 Before Market Goldman Sachs (GS) NA High Apr 14 After Market Intel Corporation (INTC) 0.02 High Apr 14 Before Market Johnson & Johnson (JNJ) 1.22 Medium Apr 14 8:30 AM Retail Sales 0.3% High Apr 14 8:30 AM Retail Sales ex-auto 0.1% High

Apr 15 8:30 AM Core CPI 0.1% High Apr 15 8:30 AM CPI 0.2% High

Apr 15 2:00 PM Fed's Beige Book NA High

Apr 16 After Market Google (GOOG) 4.95 High Apr 16 06:30 am ET JPMorgan Chase & Co (JPM) 0.31 High

Apr 17 Before Market Citigroup Inc. (C) -0.36 High Apr 17 Before Market General Electric (GE) 0.21 High

Apr 14 Before Market Goldman Sachs (GS) NA High Apr 14 After Market Intel Corporation (INTC) 0.02 High Apr 14 Before Market Johnson & Johnson (JNJ) 1.22 Medium Apr 14 8:30 AM Retail Sales 0.3% High Apr 14 8:30 AM Retail Sales ex-auto 0.1% High

Apr 15 8:30 AM Core CPI 0.1% High Apr 15 8:30 AM CPI 0.2% High

Apr 15 2:00 PM Fed's Beige Book NA High

Apr 16 After Market Google (GOOG) 4.95 High Apr 16 06:30 am ET JPMorgan Chase & Co (JPM) 0.31 High

Apr 17 Before Market Citigroup Inc. (C) -0.36 High Apr 17 Before Market General Electric (GE) 0.21 High

Wednesday, April 8, 2009

Subscribe to:

Posts (Atom)

Archive

-

▼

2009

(180)

- January (17)

- February (23)

- March (20)

- April (13)

- May (18)

- June (16)

- July (10)

- August (9)

- September (16)

- October (12)

- November (12)

- December (14)

-

►

2010

(210)

- January (20)

- February (32)

- March (17)

- April (25)

- May (33)

- June (4)

- July (10)

- August (2)

- September (20)

- October (16)

- November (15)

- December (16)