"If one cannot get one's own way, one must adjust to the inevitable."

The Specturm chart looks like Star Wars, light sabre show bad vs. good. The government's gross domestic product report showed that the economy fell at a -6.2 percent annual pace at the end of last year, a pace that was much faster than execpted. New CitiGroup Deal, the Prince? My Kingdom, My Kingdom . . .

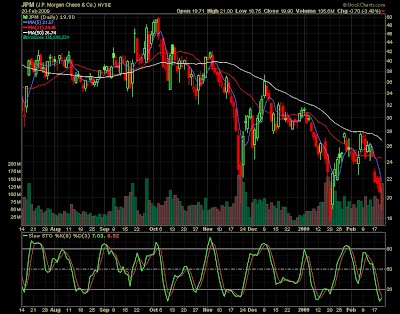

The Specturm chart looks like Star Wars, light sabre show bad vs. good. The government's gross domestic product report showed that the economy fell at a -6.2 percent annual pace at the end of last year, a pace that was much faster than execpted. New CitiGroup Deal, the Prince? My Kingdom, My Kingdom . . . Option Day Purchase: JPM Mar 20 Puts - JSAOD, for a decent profit (meaning no loss for the day). JPM had a nice range today of $2.25, HOD 21 to LOD 18.75 = Closing at 19.96. Stoch are starting to bottoming out, so this should be and considered as a warning. This is a crazy market and you should be small and take your profits when they are presented.

Option Day Purchase: JPM Mar 20 Puts - JSAOD, for a decent profit (meaning no loss for the day). JPM had a nice range today of $2.25, HOD 21 to LOD 18.75 = Closing at 19.96. Stoch are starting to bottoming out, so this should be and considered as a warning. This is a crazy market and you should be small and take your profits when they are presented.  JPM - Mar 09 JSAOD 20P

JPM - Mar 09 JSAOD 20P Looking at the Daily chart our range has been broken for now, a window as been opened and the old range was 28 to 24 per share price. There should be a restesting of the lows 20 and 18 per share price! Charts were also a cool waterfall on the 5 min and 15 min. Looking for some more downside, but round number are the stall points and with GS not help in the fast down market. We would have like quicker in and out trades with this option. However, a profit(s) is a profit.

1:15pm USD FOMC Member Lockhart Speaks - Comments helped the sell-off in the financials; whewe. Also, Bank of New York - did not like the fact of a cap on bonuses, haha. Clarity is no more for the financials?!

JPM is currently in a downtrend, even as it is one of the best in the Financial sector. It has been diffcult to trade it the last couple of days; as the market have been trending and waiting for all those Economic News, Congress Hearings. JPM trading range is at 28 to 24 per share. Friday was a attempt to sell the news, as we where all ready knowing that the House and Senate would passed the bill. It is now on the Presidential desk for signing. Also, with Monday beeing a market holiday there was no rally which normally happpens during upcoming holidays. 18 trading days left in the month of Feburary.

JPM is currently in a downtrend, even as it is one of the best in the Financial sector. It has been diffcult to trade it the last couple of days; as the market have been trending and waiting for all those Economic News, Congress Hearings. JPM trading range is at 28 to 24 per share. Friday was a attempt to sell the news, as we where all ready knowing that the House and Senate would passed the bill. It is now on the Presidential desk for signing. Also, with Monday beeing a market holiday there was no rally which normally happpens during upcoming holidays. 18 trading days left in the month of Feburary.1) Don't trade when the 4sma, 8sma and 20sma are really narrow. Wait for it to break out first.

2) Don't trade when the market is slow (like right now). You can trade at other times, but just make sure there are decent volatility / momentum.

3) Don't trade 30 minutes before or after news. If there's BIG news coming, it might not be good to trade for hours before because the market just stalls and goes nowhere (same problem as #2). This is because it's waiting for the news announcement. In this case, don't trade until after the news. Watch for News that is - High and Medium Profile.

4) Don't trade if you're up against a barrier. This includes the daily R1 R2 R3, daily S1 S2 S3, daily pivot, and weekly pivot. It's also good to look at the 15min 4sma, 8sma and 20sma to see if you're close to them as well. I also recommend treating the "00's" (239.00, 238.00, etc.) as barriers. I call them psychological barriers, and it's really just common sense. Just think about when you have a $100 bill. You're less likely to spend it. Once you finally decide to break the $100 bill, you'll usually spend your smaller bills much more quickly. This is just human nature, and well, the market is driven by human beings.

Instead of just thinking of the barriers as times not to trade, use them to your advantage. Wait for either a break through of the barrier or bounce off it. If it does this, you should still wait for the moving averages and your other indicators to give you a signal.

This is a modified strategy for the active options trader. When we are buying calls or puts, we want to do so at the lowest levels possible. To help in doing this, we put in limit orders below the previous close or most recent last closing price and let those oversold or overbrought opportunities come to us when making high probability, short term trades in stocks, electronic traded fund, and commodities. We like to have opportunities come to us, rather than chase them.

We are looking to buy the pulled back, our trading strategy is to use limit orders below the previous close or most recent last closing price. This gives us the opportunity for playing pull backs on an intraday basis, giving us an even lower priced entry into the position. It has been a valuable part of our overall approach to buying weakness and selling strength.

We use a 4-day moving average and wait for our stock to close above or below that 4-day moving average. Once it has done so, we exit at the market.

Once we have spotted our oversold stock, we look to use continued strength in the stock as an opportunity to take a position on the short side. This is the intraday strength that we talk about. In the same way that we look for intraday weakness to enter long positions, we look for intraday strength to enter short positions. By putting a sell limit order anywhere from 2% to 6% above the previous close, we allow stocks to "come to us" rather than chasing them. We've found this approach to work as well for buying strong stocks as it does for shorting weak stocks.

There are different options for short term traders following this trading strategy. If you place your limit order very close to the previous close or most recent last closing price, for example at 1-3% below that level, then you are likely to get more fills than if you placed your limit order farther away. This will mean more trades and, relatively speaking a larger number of losing trades, as well.

If you place your limit order at a greater distance from the previous close or most recent last closing price, such as 4-6%, then you will get significantly fewer trades than if your limit order were closer. But those trades will likely be more profitable as you will only be trading the deepest pullbacks and the most oversold stocks, electronic traded fund, and commodities.

Because we look to buy stocks, electronic traded fund, and commodities after they have pulled back rather than after they have broken out to new highs, our approach to entering trades is different from that of many short term trading strategies. This approach does more than just get us into trades at the lowest possible levels. It also serves to keep us disciplined rather than emotional when it comes to taking trades.

If you want to be more active as a trader, use a tighter limit order. If you only want the biggest pullbacks and don't mind missing a few of the more modest gaining trades, then go ahead and use a limit order that is 4% or more below the stocks, electronic traded fund, and commodities previous close or most recent last closing price.

One observation, with the sort of high probability, high win-rate trading opportunities that, the downside of using a tighter limit order that ostensibly increases trade frequency and potential losses is much less pronounced than it might be with other strategies with win rates closer to 50%. This is why having a strict entry rule, such as using limit order 2% to 6% below the stock's last close is so helpful. By the time an already oversold stock makes an additional 2-6% correction intraday, that stock is all more likely to have run out of willing sellers and that is the moment we are waiting for. So when looking to trade stocks, electronic traded fund, and commodities, be sure that you don't chase those trades. Put in your limit order below the previous close and let those oversold opportunities come to you.

Whichever approach you take should be based on your personality and trading preferences.