Interesting developments on the downside. Would like to see a break of the 40-day MA.

Interesting developments on the downside. Would like to see a break of the 40-day MA.Thursday, December 31, 2009

Saturday, December 26, 2009

BBY

BBY has in the past dropped like a rock after the Holiday season subsids, will it be the same for this year. The stock on a weekly basis is at the 20-day MA of $40.70; and the 40-day is forming at the $38.26 price level. We will not see the Retail Sales for Dec until Jan 14.

BBY has in the past dropped like a rock after the Holiday season subsids, will it be the same for this year. The stock on a weekly basis is at the 20-day MA of $40.70; and the 40-day is forming at the $38.26 price level. We will not see the Retail Sales for Dec until Jan 14.Upcoming EcoNews:

| 29-Dec | 9:00 | CaseShiller 20 City |

| 29-Dec | 10:00 | Consumer Confidence |

| 30-Dec | 9:45 | Chicago PMI |

| 30-Dec | 10:30 | Crude Inventories |

| 31-Dec | 8:30 | Initial Claims |

| 31-Dec | 8:30 | Continuing Claims |

Wednesday, December 23, 2009

Tradeable Optionz - Day's Scan for Dec 23rd

| WFMI – Whole Foods Market Inc. | Services |

| IBM – International Business Machines Corp | Technology |

| DE – Deere & Co | Industrial Goods |

| FSLR – First Solar Inc | Technology |

| HGSI – Human Genome Sciences Inc | Healthcare |

| WYNN – Wynn Resorts Ltd | Services |

| V – Visa Inc | Services |

| POT – Potash Corp of Saskatchewan Inc | Basic Materials |

Monday, December 21, 2009

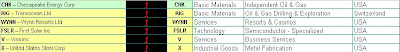

Tradeable Optionz - Day's Scan for Dec 21st

| BA – Boeing Co/The | Industrial Goods | |

| PALM – Palm Inc | Technology | |

| HPQ – Hewlett-Packard Co | Technology | |

| CHK – Chesapeake Energy Corp | Basic Materials | |

| BBY – Best Buy Co Inc | Services | |

| V – Visa Inc | Services | |

| POT – Potash Corp of Saskatchewan In | Basic Materials | |

| ORCL – Oracle Corp | Technology |

Thursday, December 17, 2009

Mid Day's Scan for Dec 17th

| AUY – Yamana Gold Inc | Basic Materials |

| CVX – Chevron Corp | Basic Materials |

| HGSI – Human Genome Sciences Inc | Healthcare |

| JNPR – Juniper Networks Inc | Technology |

| MS – Morgan Stanley | Financial |

| MON – Monsanto Co | Basic Materials |

| COF – Capital One Financial Corp | Financial |

| RIG – Transocean Ltd | Basic Materials |

| V – Visa Inc | Services |

| GG – Goldcorp Inc | Basic Materials |

| KO – Coca-Cola Co/The | Consumer Goods |

| MOS – Mosaic Co/The | Basic Materials |

| PBR – Petroleo Brasileiro SA | Basic Materials |

| ABX – Barrick Gold Corp | Basic Materials |

| WYNN – Wynn Resorts Ltd | Services |

| POT – Potash Corp of Saskatchewan Inc | Basic Materials |

Tradeable Optionz - Day's Scan for Dec 17th

| DE – Deere & Co | Industrial Goods |

| INTC – Intel Corp. | Technology |

| NVDA – Nvidia Corp | Technology |

| SLB – Schlumberger Ltd | Basic Materials |

| POT – Potash Corp of Saskatchewan Inc | Basic Materials |

| FSLR – First Solar Inc | Technology |

| X – United States Steel Corp | Industrial Goods |

Wednesday, December 16, 2009

Tradeable Optionz - Day's Scan for Dec 16th

| STI – SunTrust Banks Inc | Financial |

| IBM – International Business Machines Corp | Technology |

| MON – Monsanto Co | Basic Materials |

| COF – Capital One Financial Corp | Financial |

| RIG – Transocean Ltd | Basic Materials |

| WYNN – Wynn Resorts Ltd | Services |

| V – Visa Inc | Services |

| BBY – Best Buy Co Inc | Services |

Tuesday, December 15, 2009

Saturday, December 12, 2009

Tradeable Optionz - Day's Scan for Mon 14th

Thursday, December 10, 2009

Tuesday, December 8, 2009

Thursday, December 3, 2009

Ben, Ben, Ben, Ben

Shorten trading day for me, as I have things to do. Trading on Friday should be better. Unemployment numbers are going out.

Today's Completed Orders

| Symbol | Action | Qty | |||

| SPYXG SELL TO CLOSE | 10 | ||||

| SPYXG BOUGHT TO OPEN | 10 | ||||

| SPYXG SELL TO CLOSE | 10 | ||||

| SPYXG BOUGHT TO OPEN | 10 |

Wednesday, December 2, 2009

Today's Completed Orders

Move Along

UUP is currently trading in a trying to filled the intraday gap. S1 22.02 up to 22.13, if we can push up to the 22.1699 this would close the intraday gap open from this morning. On a 10 minute chart. . . .

Beige Book top of the hour 2:00 et

Friday, November 27, 2009

Tuesday, November 24, 2009

SPY vs US Dollar

Today's Completed Orders

| Symbol | Action | Qty | |||

| FYNXK | SELL TO CLOSE | 10 | |||

| FYNXK | BOUGHT TO OPEN | 10 |

Monday, November 23, 2009

Dollar Tanked

SPY is coming into some resistance at the 111.74 level, more over if we can close above 110.992 and catch a bid to the upside in the next one and half days then 112 is possible relatively quick . . . It appears if we can hold this level gap fill would have the prior gaps from 11/10 - 11/20. Key is for the dollar to drop again for the next one and half days and short covering into the T-Day event, this should be good for the markets . . .

Keep the powder dry . . .

Friday, November 20, 2009

Charts Of The Third Kind

At a glance, the two charts look the same. As in one is going up and the other is going down, Ben and the boys have been propping the dollar. Concerns about the pace of a recovery have dogged the market's eight-month rally but with the nation's unemployment rate now above 10 percent for the first time in 26 years and new worries about housing, the government also will revise its early estimate that said the economy grew.

At a glance, the two charts look the same. As in one is going up and the other is going down, Ben and the boys have been propping the dollar. Concerns about the pace of a recovery have dogged the market's eight-month rally but with the nation's unemployment rate now above 10 percent for the first time in 26 years and new worries about housing, the government also will revise its early estimate that said the economy grew.So what is the connection with rise in the dollar and drop in the market (spy), the stronger dollar can hurt commodities prices and sales of U.S. exporters, whose goods become more expensive overseas when the dollar rises.

Will the dollar start to climb and put the spy out of commission for awhile? Amazing!! There was no good Eco-news this week to say the least about and the market ran with it to the downside. Can the govt continue to use these tacky tacky to prop the dollar. If you have ever gone down to the 1 min charts, it is bots wars.

On that note: Volume will be light again next week because of Thanksgiving. Even with the holiday, the week brings a flurry of reports on home sales, unemployment, consumer confidence and demand for big-ticket manufactured goods.

Ding, Ding round $64 thousand dollar question.

Today's Completed Orders

| Action | Qty | |||

| SPYXN SELL TO CLOSE | 20 | |||

| SPYXN BOUGHT TO OPEN | 20 |

Wednesday, November 18, 2009

Closed Order For The Day

Today's Completed Orders

| Symbol | Action | Qty | |||

| SPYXG | SELL TO CLOSE | 10 | |||

| SPYXG | BOUGHT TO OPEN | 10 |

Tuesday, November 10, 2009

AIG - Payout

| Well it is Veteran Day on Wednesday and there maybe a slow trading. Bond market will be closed and Federal Offices . . . We closed out of the following positions and maybe looking to get into them again on V-Day however it maybe a very slow trading day, as it was today. AIG - NOV 09 IKGKH 34 C |

| AIG - DEC 09 IKGXJ 36 P |

Saturday, November 7, 2009

No Trades - Friday

Unemployment was bad and then a bounce. Hummm. . . . Looking to see a slow to strong start on Monday morning, after the weekend of NY parties. Time well tell and we will have to see.

Thursday, November 5, 2009

10 Cent and Hour

| Shorten day and only three trades for 10 cent and hour of work. AIG - NOV 09 IKGKJ 36 C |

| AIG - NOV 09 IKGKJ 36 C |

| AIG - NOV 09 IKGKK 37 C Those trading computers are killer in the morning . . . We just have to figure out our new plan of attack. Most of the traders I know are back to scapler mode, there is not waiting and see. |

Wednesday, November 4, 2009

All Positions Closed Out

| All I have to say is wow and it seems the spreads are getting larger everyday. SPY - DEC 09 FYNLA 105 C |

| SPY - DEC 09 FYNXA 105 P |

| AIG - NOV 09 IKGKI 35 C |

| AIG - NOV 09 IKGKJ 36 C |

| AIG - NOV 09 IKGKJ 36 C |

| AIG - NOV 09 IKGWL 38 P |

Sunday, November 1, 2009

Oregon - Congrats!! Win over USC

Friday, October 30, 2009

MetLife (MET 36.84) reported in-line earnings for its third quarter, but reported a net loss driven by some $857 million in derivative losses.

MetLife (MET 36.84) reported in-line earnings for its third quarter, but reported a net loss driven by some $857 million in derivative losses.Premarket gainers: GNW +13%.% RVSN +11%. EL +8%. LVS +8%. VVUS +8%. AIXG +7%. YRCW +5%. MGM +5%. CMI +4%. SHPGY +4%.

Losers: NVTL -19%. SMP -12%. ALU -8%. MTW -7%. CIT -6%. CBEH -7%.

Thursday, October 29, 2009

Tuesday, October 20, 2009

Monday, October 19, 2009

Sunday, October 18, 2009

Thursday, October 15, 2009

Should Be Interesting To See

Currently WYNN is in a sideways pattern between $60 and $70 dollars per share. Looking for a break either way. $71-$75 level are pullback areas for this stock.

SL Green Realty Corp. REIT - Retail USA SLG $45.62

It appears SLG is creating another bull flag, so we are looking for confirmation to the upside on this one. This is a beautiful chart, caution to the beholder.

Wednesday, October 14, 2009

PAC-10 Standings

Let's go Oregon!! Up next: At Washington Oct 24. The Oregon coaches are tight-lipped on whether Masoli will be able to return to the lineup. However, Oregon has two weeks to prep for Washington (in Seattle).

Let's go Oregon!! Up next: At Washington Oct 24. The Oregon coaches are tight-lipped on whether Masoli will be able to return to the lineup. However, Oregon has two weeks to prep for Washington (in Seattle).Audiable Notes: Husky Stadium (72,500): The sound bounces off the roof, rocks the stadium and settles over the playing field. Compared to the Autzen Stadium (54,000): It’s non-stop, eardrum-rattling, jet-engine level, false-start causing noise.

Wednesday, October 7, 2009

Flat To Down

AIG and GS were good for scalping at the open and then went flat for the day . . .

Friday, October 2, 2009

Tuesday, September 29, 2009

Top Day Trader Alerts:

Pullback Gainers:

NYSE

None

NASDAQ

Sequenom Inc. SQNM 3.52

Pullback Losers:

NYSE

Walgreen WAG 37.40

NASDAQ

None

This morning's top alerts on volume. Disclaimer: This article should not be considered a recommendation to buy or sell securities and readers should conduct their own due diligence prior to making any investment decisions. The author has no obligation to update this article in light of changing future circumstances or post an article prior to taking further actions in the following securities. All securities should be closed before 10:00 ET.

Friday, September 25, 2009

Mar Pattern

Thursday, September 24, 2009

Watchlist EcoNews

This is an EconWatchlist for Sep 25.

Sep 25 8:30 AM Durable Orders for Aug Expected 0.4% Prior 5.1%

Sep 25 10:00 AM New Home Sales for Aug Expected 440K Prior 433K

SPF [NYSE]

Standard Pacific Corp.

Industrial Goods - Residential Construction - USA

RMIX [NASD]

US Concrete Inc.

Industrial Goods - Cement - USA

MTH [NYSE]

Meritage Homes Corporation

Industrial Goods - Residential Construction - USA

Wednesday, September 23, 2009

Watchlist EcoNews

This is an EconWatchlist for Thursday 24, 2009; remember market sold off hard into Wednesday 23, 2009 close. After today's market info day - FOMC interest rate, Timmy G. Speak and not to forget Obama Speak to the UN, everyone said I'm taking mine. 1. Profit. 2. Do Not Lose 3. Trade it again.

8:30 AM Initial Claims - for 09/19 Expected 550K Prior 545K

10:00 AM Existing Home Sales - for Aug Expected 5.35M Prior 5.24M

Top Day Trader Alerts

NYSE

Telecom Argentina TEO 18.00, Jarden Corp. JAH 30.00,

General Mills GIS 63.50, Rio Tinto RTP 181.28

NASDAQ

Google Inc. GOOG 501.80, Xilinx Inc. XLNX 24.50,

Ascent Solar Techn ASTI 8.58, Baidu Inc. Ads BIDU 397.50,

Wynn Resorts Ltd. WYNN 73.90

Pullback Losers:

NYSE

Walter Energy Inc WLT 62.81, Autozone Nevada AZO 149.10,

Transocean Ltd RIG 84.59

NASDAQ

Atp Oil & Gas Corp. ATPG 19.92, Northern Technolog NTIC 1.80

Hlth Corp. HLTH 13.48

This morning's top alerts on volume. Disclaimer: This article should not be considered a recommendation to buy or sell securities and readers should conduct their own due diligence prior to making any investment decisions. The author has no obligation to update this article in light of changing future circumstances or post an article prior to taking further actions in the following securities. All securities should be closed before 12:00 ET.

Top Day Trader Alerts

NYSE

Telecom Argentina TEO 18.00, Jarden Corp. JAH 30.00,

General Mills GIS 63.50, Rio Tinto RTP 181.28

NASDAQ

Google Inc. GOOG 501.80, Xilinx Inc. XLNX 24.50,

Ascent Solar Techn ASTI 8.58, Baidu Inc. Ads BIDU 397.50,

Wynn Resorts Ltd. WYNN 73.90

Pullback Losers:

NYSE

Walter Energy Inc WLT 62.81, Autozone Nevada AZO 149.10,

Transocean Ltd RIG 84.59

NASDAQ

Atp Oil & Gas Corp. ATPG 19.92, Northern Technolog NTIC 1.80

Hlth Corp. HLTH 13.48

This morning's top alerts on volume. Disclaimer: This article should not be considered a recommendation to buy or sell securities and readers should conduct their own due diligence prior to making any investment decisions. The author has no obligation to update this article in light of changing future circumstances or post an article prior to taking further actions in the following securities. All securities should be closed before 12:00 ET.

Monday, September 21, 2009

Top Day Traders Alerts

Pullback Gainers:

NYSE

Rio Tinto RTP 172.92 Potash Corp Of Sas POT 92.25

Boston Properties BXP 67.74 Siemens SI 95.25

NASDAQ

Baidu Inc. Ads BIDU 396.50, Google Inc. GOOG 488.00,

Randgold Resources GOLD 71.53, First Solar Inc. FSLR 154.46,

Wynn Resorts Ltd. WYNN 67.51, Intuitive Surgical ISRG 246.50,

Garmin Ltd. GRMN 35.25, Delta Petroleum Co DPTR 2.84,

Apple Inc. AAPL 183.85 Lincoln Electric H LECO 51.50

Pullback Losers:

NYSE

Perot Systems Cla PER 29.68, Odyssey Re Holding ORH 64.70

Cytec Industries CYT 34.80, Monster Worldwide MWW 18.53

NASDAQ

Acorda Therapeutic ACOR 29.56, Cme Group Inc. CME 305.45,

AMGN 62.15, Nektar Therapeutics, NKTR 9.74,

ChinaBiotics Inc. CHBT 16.00, Celgene Corp. CELG 53.45,

Netapp Inc. NTAP 25.50, Hain Celestial Gro HAIN 18.35,

Impax Laboratories IPXL 9.48 Lincare Holdings I LNCR 30.89

This morning's top alerts on volume. Disclaimer: This article should not be considered a recommendation to buy or sell securities and readers should conduct their own due diligence prior to making any investment decisions. The author has no obligation to update this article in light of changing future circumstances or post an article prior to taking further actions in the following securities. All securities should be closed before 12:00 ET.

Sunday, September 20, 2009

Earnings Annoucements

Chart courtesy of http://www.finviz.com/ ( click to enlarge )

Chart courtesy of http://www.finviz.com/ ( click to enlarge )Economic News and Events

Sep 23 2:15 PM FOMC Rate Decision

Sep 24 10:00 AM Existing Home Sales

Friday, September 18, 2009

Top Day Trader Alerts:

Pullback Gainers:

NYSE

Baker Hughes BHI 41.49, Interoil Corp. IOC 39.22,

Hhgregg Inc HGG 15.75, Grace Wr & Co GRA 20.26.

NASDAQ

Sxc Health Solutio SXCI 43.88, Jinpan Internation JST 29.94,

Athenahealth Inc. ATHN 38.42, Dg Fastchannel Inc. DGIT 18.85,

Bancfirst Corp. BANF 37.53, Portfolio Recovery PRAA 46.76,

Arch Capital Group ACGL 65.55.

Pullback Losers:

NYSE

Cf Industries Hold CF 92.85, Occidental Petrole OXY 79.08,

Southwestern Energy SWN 45.93, AgnicoEagle Mines AEM 70.65,

Peabody Energy BTU 40.59.

NASDAQ

Stec Inc. STEC 32.36, Fuqi International FUQI 30.61,

Joy Global Inc. JOYG 48.52, Seahawk Drilling I HAWK 35.50.

This morning's top alerts on volume. Disclaimer: This article should not be considered a recommendation to buy or sell securities and readers should conduct their own due diligence prior to making any investment decisions. The author has no obligation to update this article in light of changing future circumstances or post an article prior to taking further actions in the following securities. All securities should be closed before 12:00 ET.

Thursday, September 17, 2009

Wednesday, September 16, 2009

Watchlist - Sep 16 2009

Sunday, September 13, 2009

Getting a Handle on EcoNews

- Tuesday: Core Retail Sales (0.4%), PPI (0.9%), Retail Sales (1.8%), Empire State Manufacturing index (15.2), Fed Bernanke speaks (10AM), Business inventories (-0.7%)

- Wednesday: Core CPI (0.1%), Current account (-92B), TIC Long-term purchases (60.3B), Capacity utilization rate (69.1%)

- Thursday: Unemployment claims (554K), Building permits (0.58M), Housing starts (0.59M), Philly Manufacturing index (8.1), Friday: Options Expiration Week

Friday, September 11, 2009

What Does $10 Dollars Buy Nowadays?

Chart courtesy of http://www.trixychart.com/ ( click to enlarge )

Chart courtesy of http://www.trixychart.com/ ( click to enlarge )Thursday, September 10, 2009

Chart courtesy of http://www.stockcharts.com/ ( click to enlarge )

Chart courtesy of http://www.stockcharts.com/ ( click to enlarge )Disclosure: The author purchased shares of AIG Wednesday at an average price of $36.00 This article should not be considered a recommendation to buy or sell securities and readers should conduct their own due diligence prior to making any investment decisions. The author has no obligation to update this article in light of changing future circumstances or post an article prior to taking further actions in either security.

Friday, September 4, 2009

Watchlist - Sep

Premarket

PremarketGainers: LTXC +25%. FNM +5%. AMED +5%. NVLS +4%. FRE +4%. CPSL +4%.

Losers: ARRY -27%. ELN -5%. ANF -4%

August Nonfarm Payrolls: -216,000 vs. consensus of -230K. July revised to -276K from -247K. Unemployment 9.7% vs. consensus of 9.5%. Bottom line: Aug. was better than expected, but most of that came from the July revision. Unemployment was 0.2 points worse than expected.

Saturday, August 29, 2009

Saturday, August 22, 2009

Watchlist for Aug 24-28

Monday, August 17, 2009

Wednesday, August 12, 2009

Notable Earning Report - Update

Aug 13 Watchlist - Earning day

Closing Price: $51.88 +1.37 (+2.71%)

50 Strike Call - .WMTLJ 3.65

(4 x 365 = $1,460.00)

50 Strike Put - .WMTXJ 1.93

(4 x 193 = $772.00)

Wal-Mart foresees same-store sales in the current quarter between flat and 2 percent higher than a year earlier, and it raised its full-year profit guidance to $3.50 to $3.60 per share, from $3.45 to $3.60 per share.

In the quarter that ended July 31, Wal-Mart earned $3.44 billion, or 88 cents per share, while revenue fell 1.4 percent to $100.08 billion. Analysts surveyed by Thomson Reuters projected earnings per share of 85 cents on revenue of $102.9 billion.

The company's international sales fell 5.1 percent, hurt by the impact of currency exchange rates.

_______________________________________________________

Well it closed over $50 per share (as of Aug 12, 2009) and it was higher intraday. $50 Option updated:

Well it closed over $50 per share (as of Aug 12, 2009) and it was higher intraday. $50 Option updated:Closing Price $50.51 +0.74 (+1.49%) 50.53 x100 50.80 x1,900 18,204,831

Aug 12 Watchlist exit

50 Stike - Call .WMTLJ exit point or better 3.00

(4 x 300 = $1,200)

50 Strike - Put .WMTXJ exit point or better 2.59

(4 x 259 = $948)

Total = Calls profitable

Total = Puts maybe worth a little more before Dec. expiration or after earnings in a couple of weeks. We will have to see, time will tell.

Aug 10 Watchlist entry

50 Strike - Call .WMTLJ entry point or better 2.37

(4 x 237 = $948)

Strike - Put .WMTXJ entry point or better 3.50

(4 x 350 = $1,400)

Total = $2,348.00 less commission.

Sunday, August 9, 2009

Notable Earning Report - This week

The government's July retail sales data as well as quarterly scorecards from major retailers, including Wal-Mart Stores Inc (WMT.N), J.C. Penney (JCP.N) and Macy's (M.N), will give a snapshot of the industry and how consumer spending is faring in the recession. So far, consumers have tightened their belts and shopped mostly for just the bare necessities as worries about job security take precedence

Archive

-

▼

2009

(180)

- January (17)

- February (23)

- March (20)

- April (13)

- May (18)

- June (16)

- July (10)

- August (9)

- September (16)

- October (12)

- November (12)

- December (14)

-

►

2010

(210)

- January (20)

- February (32)

- March (17)

- April (25)

- May (33)

- June (4)

- July (10)

- August (2)

- September (20)

- October (16)

- November (15)

- December (16)

Click on pic to enlarge.

Click on pic to enlarge.