A question I get asked quite often is – “How Much Is This Option Worth?” Its not hard to find out this information, as your trading platform should provide this information to you .

You can use this information for gaps up and gaps down. As options, do not trade in the "Pre-Market" You need to know what the delta is for your strike price, here is a simple calculation. In the above example AAPL, was trading late after the announcement of the next IPhone.

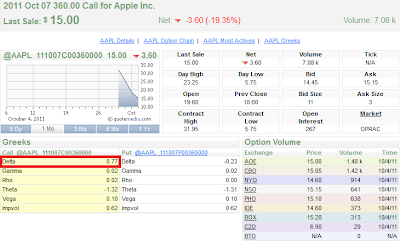

Delta: 0.77 ( Delta tells you how much the option will move with a dollar move in the underlying Stock or Index)

Multiply

Point Value Move of the Underlying Stock or Index: 9

Current Market Price

Entry Price: 6

Add

Looks like this

9 x .77 = 6.93 + 6 = 12.93 Gap Up (round to the near number = 12.90 exit price of better). Also, the reverse would be to subtract, if AAPL continued in a decline.

Quite simply, the delta represents the change in dollar value of the option as AAPL stock or index moves up or down $1.00. Remember, the delta is based on a $1.00 stock or index movement. If AAPL or index had increase only $.50, the delta is cut in half.