Sunday, May 30, 2010

Friday, May 28, 2010

SPY - Daily Update

Markets are in trading range, so far going into Memorial Weekend and Monday's market is closed for the Holiday. Looking forward to some more volatility in June, but we will have to see. SPY on a Weekly basis is still in a downward trend. As, looking at this chart the market may try and fill the gap down left May 20, 2010. Let see what the play will be in the next coming days.

Tuesday, May 25, 2010

SPY - Updated

Monday, May 24, 2010

Sunday, May 23, 2010

Tuesday, May 18, 2010

SPY - Updated

Well, we tanked. The White line on the chart, is the White line in the Sand sort of, appears no one wants to be in the market in front of the CPI, CORE CPI, and FOMC Meeting Minutes. This were the USA will start to bounce of around so than not. Thurs, Philadelphia Fed Manufacturing Index, Initial Jobless Claims, then Fri its all about EUR stuff and Options Ex.

Monday, May 17, 2010

Sunday, May 16, 2010

Saturday, May 15, 2010

Weekend Update - SPY / UUP Hourly Charts

Friday, May 14, 2010

SPY/UUP - Hourly Charts Updated

SPY was screaming this morning (smoking hot), to the downside, as the UUP which is a US Dollar ETF was roaring to new highs for the morning. Looks like the we will have some paring to do with the HFT and PPT systems. If the market wants to become flat or slightly down into the weekend. Not?!? There is very good institution selling into the weekend. Will see what they decide to do for this weekend and possible into options exp. week, next week.

Thursday, May 13, 2010

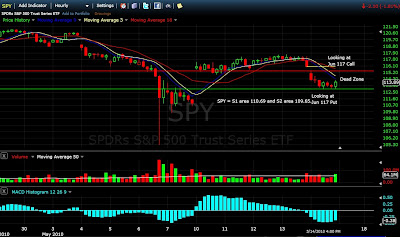

SPY - Hourly Chart Update

SPY are bouncing all over the place and it appears 117 is a good deal of resistance in the the near short term. MACD is confirming a bearish downward trend in this hourly chart and institution volume selling for today was awesome . . . Will have to see what the weekend will bring for us. Looking to maybe purchasing a 117 options straddle for Jun expiration. We would like to see a re-fill of the gap that was left behind, but, it will be quite a handful with the government in Wall Street affairs. Or maybe, not.?? Markets do not like uncertainty.

Tuesday, May 11, 2010

Monday, May 10, 2010

Sunday, May 9, 2010

Futures Up - US Dollar Drops - Will It Hold There?

Maybe a trap, as there is no real EcoNews and Mondays are usually flat to low volume trading days of late. Jobless numbers on Thursday and Retail Sales on Friday. It all about the Dollar and Greece. EU has prepared, presented a bailout package this weekend and should also see a boost from it in a short term feel good moment.

Saturday, May 8, 2010

Friday, May 7, 2010

LVS - After Earnings

Earnings were better than analysts had thought, but, what a way to have earnings presentation in a downward market trend. Puts won this round, that the time of this post.

Call

| 19.00 | LJJ100619C00019000 | 3.40 |

| 26.00 | LVS100619P00026000 | 5.90 |

Thursday, May 6, 2010

Circuit-Breakers Levels for 2010

In response to the market breaks in October 1987 and October 1989 the New York Stock Exchange instituted circuit breakers to reduce volatility and promote investor confidence. By implementing a pause in trading, investors are given time to assimilate incoming information and the ability to make informed choices during periods of high market volatility.

Rule 80B

Effective April 15, 1998 the SEC approved amendments to Rule 80B (Trading Halts Due to Extraordinary Market Volatility) which revised the halt provisions and the circuit-breaker levels. The trigger levels for a market-wide trading halt were set at 10%, 20% and 30% of the DJIA, calculated at the beginning of each calendar quarter, using the average closing value of the DJIA for the prior month, thereby establishing specific point values for the quarter. Each trigger value is rounded to the nearest 50 points.

The halt for a 10% decline would be one hour if it occurred before 2 p.m., and for 30 minutes if it occurred between 2 and 2:30, but would not halt trading at all after 2:30. The halt for a 20% decline would be two hours if it occurred before 1 p.m., and between 1 p.m. and 2 p.m. for one hour, and close the market for the rest of the day after 2 p.m. If the market declined by 30%, at any time, trading would be halted for the remainder of the day.

Under the previous Rule 80B trigger points (in effect since October 19, 1988) for a market-wide trading halt, a decline of 350 points in the DJIA would halt trading for 30 minutes and a drop of 550 points one hour. These trigger points were hit only once on October 27, 1997, when the DJIA was down 350 at 2:35 p.m. and 550 at 3:30, shutting the market for the remainder of the day.

SPY - Whee, WOW

SPY dropped like a rock only to somewhat recapture the move to the upside. In the coming days we will probably see a retest of 105 level. HFT or not someone wanted out and fast. Remember, December 2009 before the New Year. Not as big, but, very - very interesting. GS only drop slightly -4/-6 points (Market Maker) how much did you make . . . Mr. Market Maker.

LVS - Updated

Looking for some earnings protection, LVS reports tonight.

Jun 2010 Expiration

Call

| 19.00 | LJJ100619C00019000 | 4.45 | 4.35 | 4.45 | 3 | 7,188 |

| 26.00 | LVS100619P00026000 | 4.85 | 4.65 | 4.75 | 10 | 1,353 |

Futures - Updated

Wednesday, May 5, 2010

SPY and GE - Updated

Futures - In Play

Tuesday, May 4, 2010

GE - Updated

Futures - Updated

Saturday, May 1, 2010

Archive

-

►

2009

(180)

- January (17)

- February (23)

- March (20)

- April (13)

- May (18)

- June (16)

- July (10)

- August (9)

- September (16)

- October (12)

- November (12)

- December (14)

-

▼

2010

(210)

- January (20)

- February (32)

- March (17)

- April (25)

- May (33)

- June (4)

- July (10)

- August (2)

- September (20)

- October (16)

- November (15)

- December (16)